The term cryptocurrency was not the hottest topic before 2020. The reign of cryptocurrency just began at the time of the pandemic in 2020. That doesn't mean that cryptocurrency was completely unknown to people before 2020, the first cryptocurrency that is Bitcoin was released in 2009, people rarely gave attention to any form of cryptocurrencies till 2015.

How Cryptocurrency Became Popular in 2020

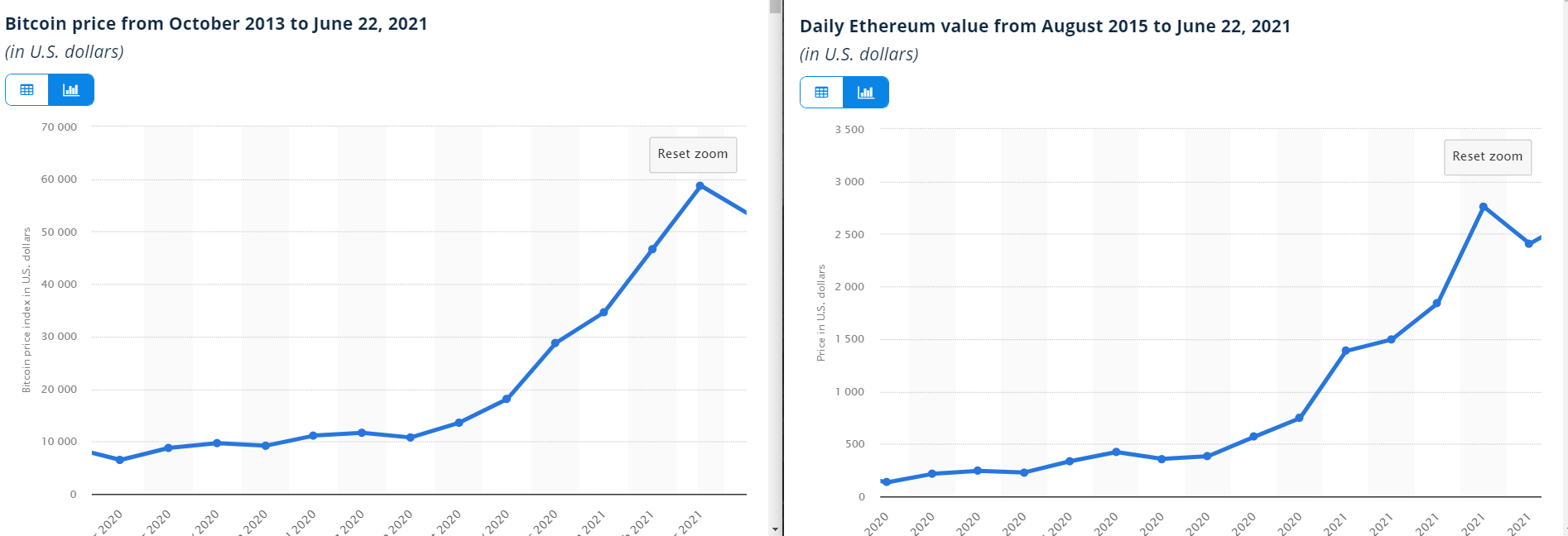

Fyi, Bitcoin's price reached from 6483 USD to 28,768 USD between March and December of 2020. Never had ever Bitcoin price experience such a dramatic change before that.

Another similar case was found in Ethereum's price. The price of an Ethereum rose from 134 USD to 746 USD (March to December of 2020). It didn't stop here and reached its peak of 2.76k USD in April 2021.

Although not all cryptocurrencies became wealthier in 2020, it's just the searches and queries over cryptocurrency and its forms that rose in 2020. A large proportion of people around the world lost their job due to the outbreak of pandemics.

Indirectly or directly, it has encouraged a lot of people to earn passive money from home.

To earn passive money while sitting at home, a majority of the people started working on online platforms. Many people chose freelancing, trading, etc.

The impact of the COVID-19 outbreak:

After a sudden fall in the price of several cryptocurrencies at the time of the pandemic (March), a vast proportionate of people saw it as an opportunity and purchase them with the hope of better return, and boom, the price of Bitcoin and Ethereum sky-rocketed, at the same time, it is certain to say a lot of people also goes in loss.

|

| Bitcoin popularity rises during 2020 and 2021. |

A large proportion of people around the world lost their job due to the outbreak of pandemics.

Indirectly or directly, it has encouraged a lot of people to earn passive money from home.

To earn passive money while sitting at home, a majority of the people started working on online platforms.

Many people chose freelancing, trading, etc.

After a sudden fall in the price of several cryptocurrencies at the time of the pandemic (March), a vast proportionate of people saw it as an opportunity and purchase them with the hope of better return, and boom, the price of Bitcoin and Ethereum sky-rocketed, at the same time, it is certain to say a lot of people also goes in loss.

According to BSFI-ET: Since the outbreak of coronavirus, the connection between Bitcoin and the equities market has risen. For example, on twelve March, the value of Bitcoin knocked down below $4,000 after the S&P Index in the USA saw an unexpected fall.

The cause for this was there was a sudden flight to liquidity, and so, a lot of investors had margin calls in Equity that had to be covered by liquidating other assets like Bitcoins into cash - to meet those margin calls elsewhere.

Though the price has now recovered to around $7,000, it will probably be a while before Bitcoin prices soar up again.

There is a lot of uncertainty in how things will pan out and BTC is no exception. Though the correlation seems to be coming off a little bit between S&P and BTC.

The dilemma is that the 12th March liquidity crisis has alarmed some cryptocurrency investors and some market makers as seen in the data of Bitmex.

I predict a progressive rise in the prices again, and more so post halving as some miners are yielded (wasteful miners will have to close down), but it won’t be sufficient because the global economy itself is one of the worst circumstances.

Crypto adoption:

The increasing population on earth too had played a role in developing the popularity of cryptocurrencies.

When major conglomerates started adopting cryptocurrencies as the mean of transactions, people started developing faith in it.

A similar circumstance occurs in October of 2020, the global digital payments corporation Paypal declared that it would be originating buying and selling features for cryptocurrencies on its program.

The launch introduced four highly traded cryptocurrencies, namely Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Paypal has also published plans to allow transactions to be made using cryptocurrencies.

Paypal is acknowledged to have 350 million users who will now be able to adopt crypto coins as a payment means. Now it is one of the most prominent names jumping on the campaign.

Along with the support of PayPal along with its associated members, there has been more demand for the asset classes, thus contributing to its rise in its popularity, indirectly playing a role in raising their prices.

According to CLS: In a new article, we examined how the market cap and trading volume of the best 100 cryptocurrencies associated with the number of Covid-19 crises and mortality worldwide in the initial days of the pandemic (January 2020 – mid-March 2020).

Our analysis generated three exciting judgments. First, we found a positive relationship between the number of fresh Covid-19 cases (as well as deaths) and the market cap of cryptocurrencies, providing a first sign of the uptick in the market.

Next, nevertheless, we found that the link within the spread of the virus and cryptocurrencies in our specimen period held a U-Inverse shape, i.e. at first higher coronavirus cases pointed to increased speculation in the crypto market, but then the outcome converted (temporarily, as we now know).

Conclusion

Certainly, the pandemic of 2020 was one of the most solid reasons why cryptocurrencies became popular in 2020. By the term popular, I mean that the price of several cryptocurrencies rose along with the demand and lowering down of supply. Instead of causing havoc in the crypto world, the virus has actually reversed the situation.

Yet 2020 was not the best year for each and every cryptocurrency if we examined it carefully.