Bitcoin is currently the hottest topic out there in the cryptocurrency and financial world. Bitcoin has performed exceptionally well in the past two years.

Some popular influencers, as well as business magnates, have significantly contributed to the developing trust of people in Bitcoin or in any type of cryptocurrency.

There are certain things about Bitcoin that make it looks bad in the eyes of any usual article writer who collects information from various trustable and reliable sources.

Why Investors can't make a profit from Bitcoin?

Points are broken down into paragraphs to make them more engaging for the readers.

1. We view it as a pure investment.

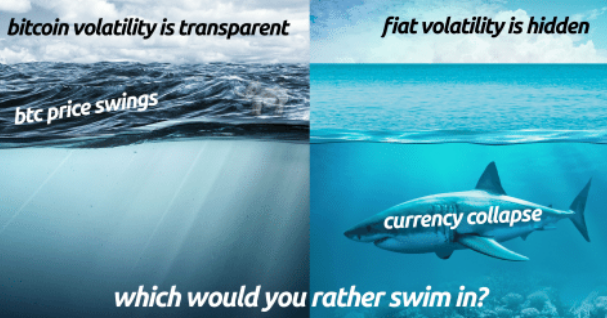

If it's a pure long-term investment, then there would be little to no volatility in the price of Bitcoin. You see how the price of a Bitcoin fluctuates regularly. For pure long-term investment, I would rather invest in gold, silver, diamond, or some rare element with growing demand.

The price of these elements also fluctuates but gold is a much safer asset because of its long existence. Whereas, Bitcoin is still gaining trust as it's a digital asset and it has just originated about a decade ago.

As Gold or other physical assets are known well as the safest assets for like a hundred years, we will still choose physical assets over Bitcoin (digital asset).

We can't categorize Bitcoin as an investment because the game has just begun and we aren't certain about how long it can keep its reign stable. We may call it a pseudo-investment or speculative investment.

Although to be practical enough, it depends on person-to-person whether they claim it as an investment or speculation because some may HODL it for a long time investment while others may sell-off in a few days.

On the view of the theoretical side, Bitcoin is an asset class and all asset classes are investments. Bitcoin is one of the riskiest investments in that theory.

2. We expect a higher profit in return at any cost.

Bitcoin has made several lives but at the same time, we are really unaware of the fact that it has caused severe financial trouble to a lot of proportion of people who have purchased Bitcoin.

The media as well as big brat advertisements have certainly grabbed attention from several inexperienced traders. They bought Bitcoin as a digital asset to fill their pocket because they have seen a rich brat showing off his money on Instagram.

Unless you are a professional or have the expertise in financial knowledge in the various fields regarding cryptocurrency, you should not put your money that you can't afford to lose all at once.

One can make a huge amount of profit with the volatility which Bitcoin has, but it requires some extra-ordinary patience and skill as well as the faith you have in God.

Extremely rich people such as popular magnates or tycoons can purchase a large proportion of Bitcoin, leading to a noticeable increase in the price of Bitcoin.

Such people are called Whales in the cryptocurrency world. If your speculation is lucky, you win the profit, if not, you may either HODL or sell it off with loss.

3. We think mining is easy to get some Bitcoins.

4. We fear volatility.

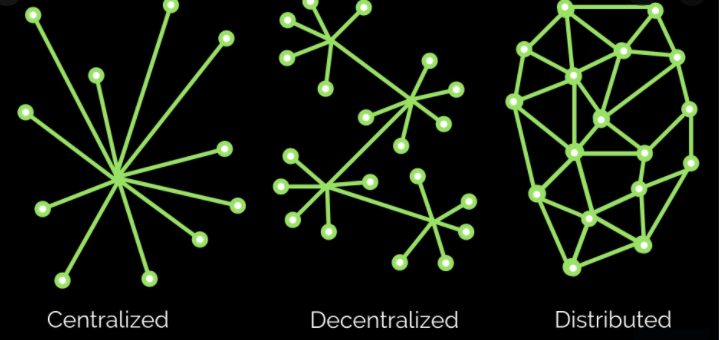

5. No authority can look after Bitcoin.

Bitcoin is an utter untruth. It is not backed by anything, anywhere. It is totalled in computer memory. Computer memory works on electricity, I don't trust having a vigorous faith in digital things as they have no existence in the real world.

Although we can trust Bitcoin to a great extent, am not saying we should not trust anything that is digitally existing, rather precautions should be arranged for the same. Bitcoin runs on its own with a network consisting of people and developers.

When a majority of people in the network decide to change the system, no one can prevent it single-handly. Depending geographically, Bitcoin has a good or bad connection with the world leaders.