- 1 bitcoin price in 2013 in Indian rupees

- 1 bitcoin price in 2014 in Indian rupees

- 1 bitcoin price in 2015 in Indian rupees

- 1 bitcoin price in 2016 in Indian rupees

- 1 bitcoin price in 2017 in Indian rupees

- 1 bitcoin price in 2018 in Indian rupees

- 1 bitcoin price in 2019 in Indian rupees

- 1 bitcoin price in 2020 in Indian rupees

- 1 bitcoin price in 2021 in Indian rupees

- bitcoin price 2013 in India

Bitcoin is rapidly growing worldwide. The rate of Bitcoin has increased a lot in recent years.

I am going to use the average rate as well as the rate of Bitcoin of a specific time, well notified as well so that it becomes easier to compare and visualize the growth rate.

Rate is the same as price. The prices are mentioned in INR (Indian Rupee).

Initially, the price started with 0 INR of course. The first significant price saw in the August of 2010 when it touched 5 Rupees.

Bitcoin Rate In India During 2010-2021

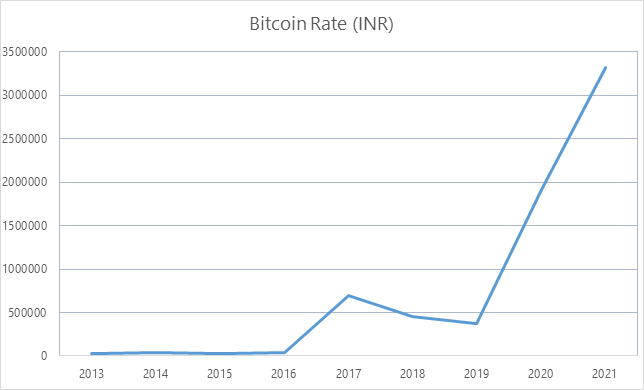

The graph is made using average price. (Average price= Initial rate + final rate of that year/ 2)

(Average Rate of years):

2010: 14 INR

2011: 150.5 INR

2012: 745.2 INR

2013: 27,424 INR

2014: 35,105 INR

2015: 24,345 INR

2016: 44,239 INR

2017: 7,09,400 INR

2018: 4,55,677 INR

2019: 3,74,220 INR

2020: 19,15,600 INR

Current price of BTC in 2021: 48,92,582 INR (15th November)

Bitcoin Rate/Price Growth in India

The price of Bitcoin was zero INR in 2009. The first momentum was gained in 2010 when the price of a Bitcoin touched 5.1 INR in August 2010. In the next year, the average price jumped by more than 10 times the value in 2010.

Bitcoin didn't perform well in 2013, 2014, 2015, and 2016. The rate of one bitcoin didn't even touch 45,000 INR (Indian Rupee) in this period.

For the first time, Bitcoin saw a sudden rise in its rate in 2017 when the price was exploded to more or less 7 lac INR (7,00,000 Indian Rupees).

Suppose if anyone from India purchased a bitcoin in 2014 when the rate of a bitcoin was around 35k INR (Indian Rupee) and sold it off in 2017.

He could have made a profit of more than 6.6 lac INR (6.6 hundred thousand Indian Rupees).

With the amount of 6.6 lac INR, you can purchase a Harley Davidson Street 750 or a Kawasaki Ninja 650. But not both.

Bitcoin has termed as the most renowned asset in 2016. Analysts are bullish on the asset class which has crossed almost all other coins.

Even gold, which was coined as a safe investment option in the time of catastrophe, has given up about all the profit it has acquired during 2016.

Just after the year 2017, the rate of bitcoin was declined as you can view in the graph. Now comes the giant rise in the rate of Bitcoin during 2020 and 2021.

The rate increased to around 20 lac INR (2 million Indian Rupees) and right now in March of 2021, a single bitcoin is worth about 43 lac INR (4.3 million Indian Rupees).

The rate was probably raised when the people got no work to do but surf around the internet due to the arrival of the great pandemic of 2020.

Imagine if someone from India bought a bitcoin in 2014 when the rate of a bitcoin was around 35k INR (Indian Rupee), and HODLed till March 2021.

That guy would have made a profit of around 42.5 lac INR (4.25 million Indian Rupees).

With that much amount of money, one could buy a Mini Cooper Countryman or a BMW 2 Series.

Bar graph

So far, we can just see the greener side of Bitcoin and are probably expecting that the rate of a bitcoin may be increased to 1 crore INR (10 million Indian Rupees) in the next few years. Remember, earning money from Bitcoin is all about speculation.

Can we expect that the rate of Bitcoin will touch 1 crore INR?

We cannot fully trust humans regarding this. Some may state that the price or the rate of Bitcoin will continue to grow more while others say that the cryptocurrency world may experience a huge crash because of the sudden rises in its value.

I disagree to the point that they are lying, but the matter of fact is that no one has seen the future, so it may be possible that the growth of the bitcoin may be suppressed due to natural or economical disasters which we aren't sure of in the future or may be due to the rise in loss of belief in cryptocurrency.

But it can even grow more in its value, probably touch 1 crore INR, or it can even replace with major fiat currencies if the trust of the people in Bitcoin rise even higher, when more and more retailers started adopting Bitcoin as a mean for the transaction, when the demand comparatively rises more than the supply, etc.

Remember, trading always involves risk and the amount of money you should put in trading should be equal to the amount you are ready to lose.

Always take the help of a financial advisor before putting your money in trading. You can find several advisors on search engines but beware of scammers. You can leave a comment on this article, thanks.

Internet users top-queries:

bitcoin price in India in 2010: 14 INR

bitcoin price in India at the start of 2010: 5 INR

bitcoin price in India in 2013:27,424 INR

bitcoin price 2013 in India:27,424 INR

bitcoin price in India 2013:27,424 INR

1 bitcoin to INR in 2014:35,105 INR

1 bitcoin price in 2014 in Indian rupees:35,105 INR

bitcoin price in the year 2014 in Indian rupees:35,105 INR

bitcoin price in the 2014 year in Indian rupees:35,105 INR

bitcoin price in the 2015 year in Indian rupees: 24,345 INR

1 bitcoin price in 2015 in Indian rupees: 24,345 INR

1 bitcoin price in the year 2015 in Indian rupees: 24,345 INR

bitcoin price in the year 2016 in Indian rupees:44,239 INR

bitcoin price in 2016 in Indian rupees:44,239 INR

1 bitcoin price in 2016 in Indian rupees- 44,239 INR

bitcoin value in 2013 in INR- 27,424 INR

Thanks for the article. I wanted to know whether Bitcoin is in bubble state or it's safe enough? Just wanted an opinion.

ReplyDeleteIt's all a speculation game. But as it is rising and has rose so far, I am talking about the pace, I think it's in a bubble state, I may be wrong because it may be possible that Bitcoin would be adopted by many more organizations, leading to a higher trust factor.

ReplyDelete