Bitcoin is a very volatile cryptocurrency having the least liquidity. The price of Bitcoin fluctuates a lot. Though the fact is that Bitcoin has grown a lot during 2020 and 2021. Many short-term investors and traders feel a question about why Bitcoin prices go down or lose their value.

Reasons why Bitcoin Price falls

Several factors play a role in deciding the price of Bitcoin, right now let's start with the factors which diminish the value of Bitcoin.

1. When a large proportion of Bitcoins is dumped

Bitcoin price plunges heavily when a large amount of it is sold in the market. It brings down the price of Bitcoin. On the other hand, if a large amount of Bitcoin is bought and HODLed, the price increases.

This is due to the supply and demand term. When the supply is more in the market, the price usually falls. While the price rises when a large proportion of cryptocurrency is HODLed by some rich investors.

The price of petroleum is ever-increasing since it's on the way to extinction, but if we find a high amount of petroleum from a newly discovered place, the price of petroleum will be reduced heavily.

Similarly, if a large amount of Bitcoin is available in the market after someone sold it off, the price gets reduced.

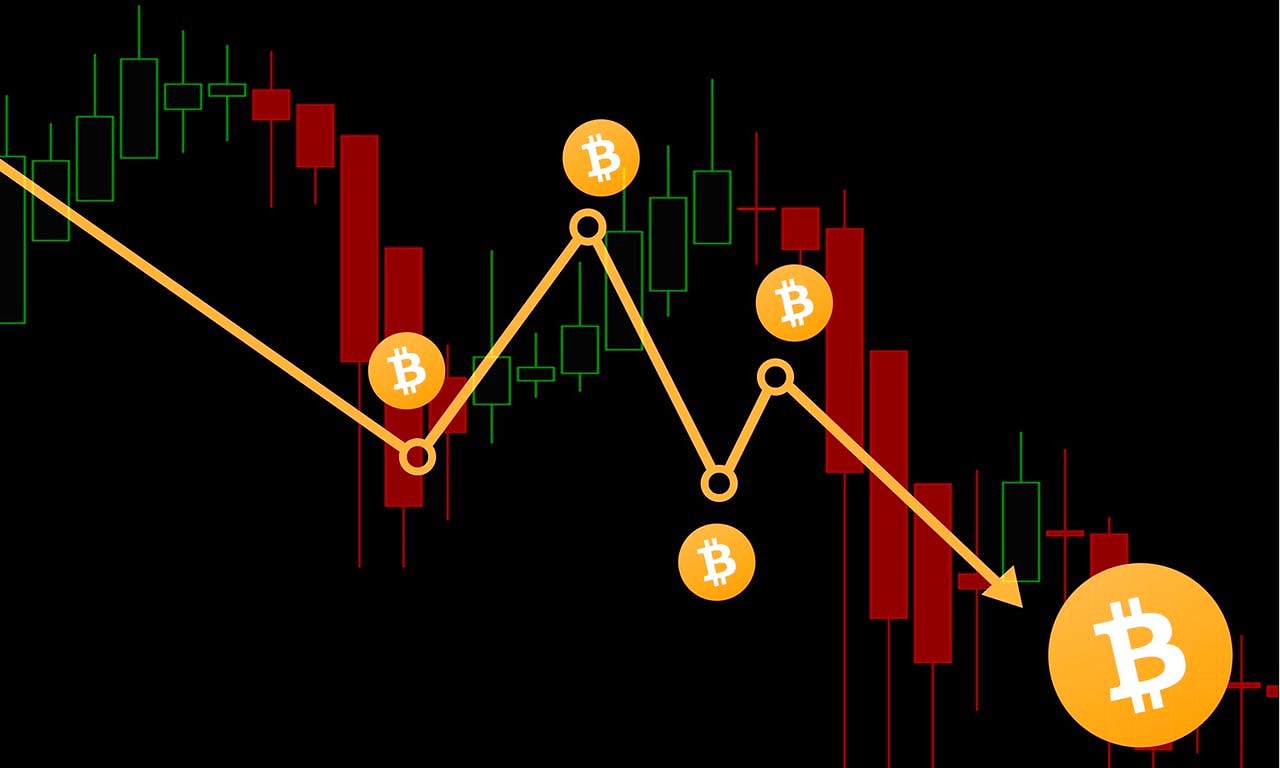

2. Impact of a sudden fall

When the price plunges sharply, many traders, in fear that they lose their money sell off all their Bitcoins. If a large number of Bitcoins are sold at a time, a deep drop in its price is followed after it.

Not everyone has a huge wallet so most probably, whenever they see a small decline in the price, they push the sell button.

This results in the fall of the price of Bitcoin. Though some traders don't lose their patience and keep holding the Bitcoin with the hope of a better day.

3. Media FUD

Media have the power to change your attention away from Bitcoin by talking about its downsides. When Media started giving negative reviews over Bitcoin, people lose their trust in it, resulting in a steep decline in the price. People believe what they hear from others.

If Bitcoin started receiving negative feedback from the majority of the Media companies, then it may be possible that Bitcoin would lose its price to around a thousand dollars, or even less than a hundred.

Negative news will generally cause people to sell their Bitcoin. Though experienced traders usually don't follow the news, they simply predict themselves by doing researches and analysis.

4. Inexperienced traders

Inexperienced traders lack knowledge. They usually fail to make money out of trading during their initial experience.

The Bitcoin rate is concluded by buyers and sellers in the Bitcoin exchanges.

However, thin volume and short-term edge trading (using leverage) result in careless fill prices about 90 per cent of the time, ending in more losses and pushes the price downward.

Inexperienced traders may chase after the performance, ignores risk aversion, let the losses grow, believes false buy signals, buying with too much margin, etc.

5. Increasing distrust against Bitcoin

Although hacking into blockchain is nearly impossible as well as the data isn't centrally stored, but connected with a huge network of computers that check every transaction and maintains authenticity.

Still, many people don't trust digital currency due to the following reasons:

1. Not regulated by central authorities.

2. Don't trust digital kinds of stuff.

3. They believe physical/fiat currencies are much safer.

4. Fear of losing the money as central authorities won't take any action against it.